The Future of CBDCs As Digital Cash: The Case of E-Yuan

Introduction

Digital innovation has brought far-reaching changes in all sectors of the economy around the globe. For example, a wave of innovation in consumer payments has placed money and payment services at the forefront of this development. During the Covid-19 pandemic, requiring social distancing measures, there were public concerns that cash may transmit the virus, further accelerating the shift toward digital payments and giving further impetus to Central Bank Digital Currencies (CBDCs).

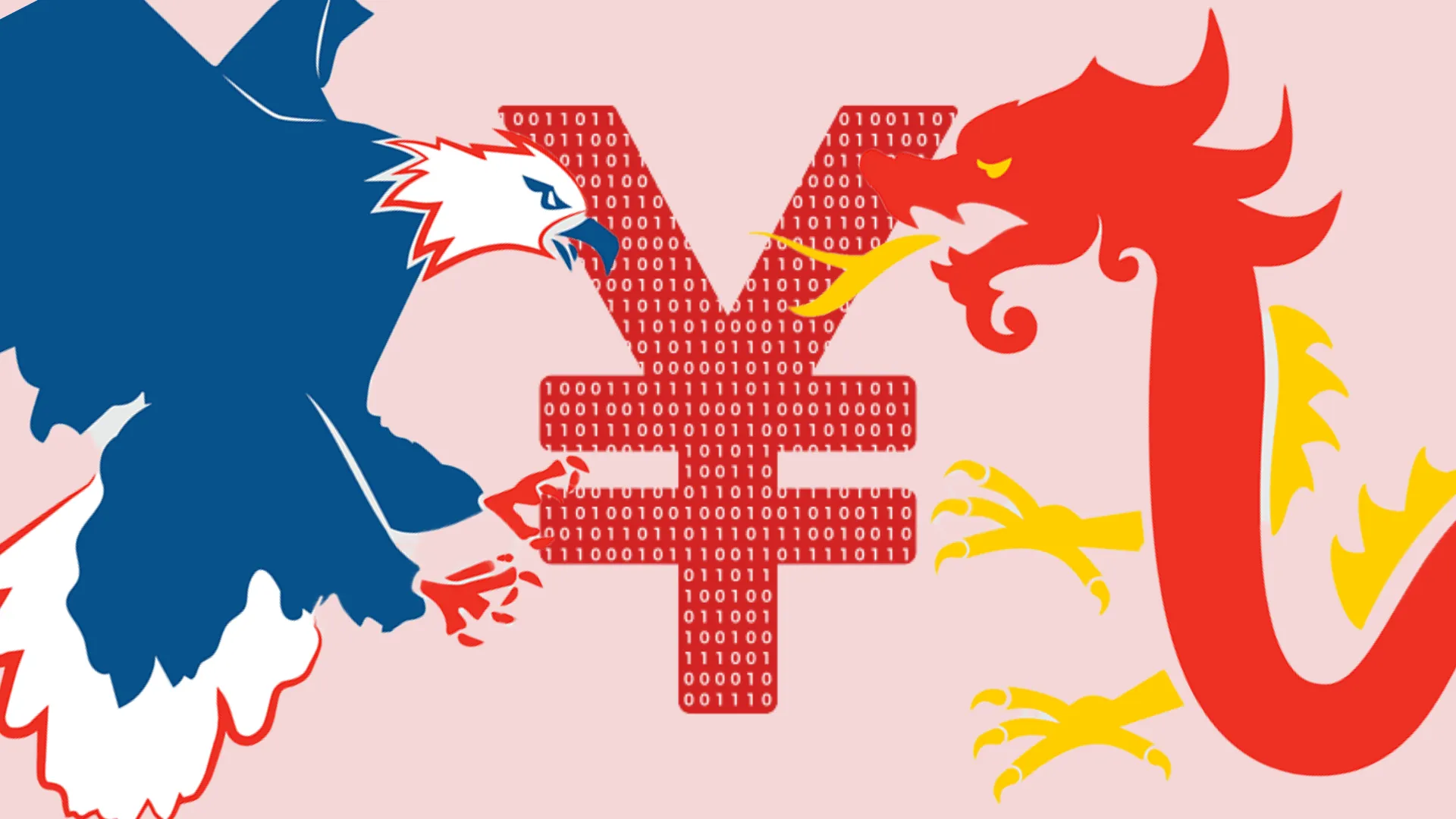

In addition, several recent developments have placed digital currencies high on the Central Bank’s agenda. First, the growing attention received by Bitcoin and other cryptocurrencies; second, the debate on the Stablecoins; and third, large technology firms (big techs) into the payment services and financial services industry.

Cryptocurrencies are indeed speculative assets rather than money. In many cases, they facilitate money laundering, ransomware attacks, and other financial crimes. Bitcoin, in particular, has few redeeming public-interest attributes when also considering its wasteful energy footprint.

Central Bank Digital Currencies (CBDCs) are a digital version of physical money issued by central banks. CBDCs are the central banks’ direct liability. They can be designed for use either among financial intermediaries only (i.e., wholesale CBDCs) or by the broader economy (i.e., retail CBDCs). It is envisaged that CBDC design in most countries will resemble their existing online platforms, but with a difference, money held as a CBDC is equivalent to a deposit with the central bank.

Therefore, this study examines the status of central bank digital currencies (CBDCs) development and provides information on the progress made by several countries. The study also examines the issuance of CBDC means for the users, financial intermediaries, central banks, and the international monetary system. The digital economy’s essential by-product is the massive volume of personal data collected and processed as an input into business activity. This raises issues of data governance, consumer protection, and anti-competitive practices arising from data silos. It presents associated implications for data governance and privacy in the digital economy – finally, the role and future of e-yuan.